Videos & Webinars

Watch videos featuring supply chain experts

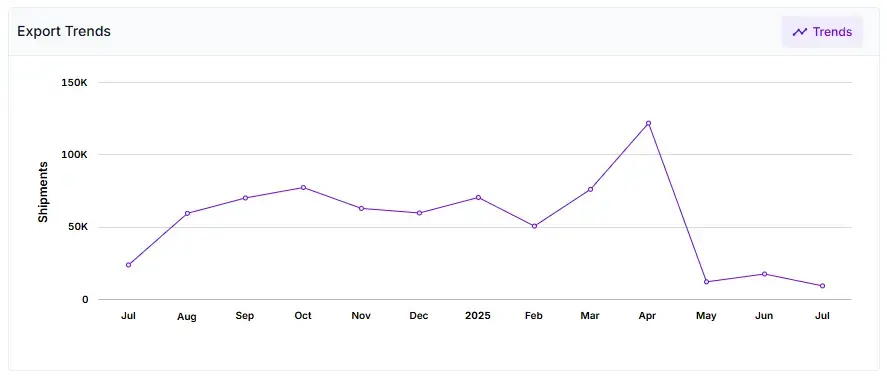

A sharp decline that underscores a broader transformation in global supply chains.

In May 2025, U.S. imports of clothing and apparel from China plunged to $556 million, down nearly 30% from April. It’s the lowest monthly total in over two decades, according to U.S. Customs data. While on its face this appears to be another monthly dip, the scale and timing of the collapse carry broader significance for fashion brands and retailers.

The primary trigger? A steep escalation in tariffs targeting Chinese apparel, raising effective duty rates to over 100% in some cases. Facing cost pressures, U.S. importers have quickly pivoted to alternative markets, namely Vietnam, Bangladesh, India, and Mexico, to sustain inventory and protect margins.

But behind this headline is a deeper reality: U.S. fashion supply chains are being reshaped faster than ever, driven not only by tariffs but also by long-running concerns about concentration risk, compliance complexity, and geopolitical volatility.

China has long been the dominant supplier of clothing to the U.S., but that dominance has been under pressure for years. In May 2025, the shift became undeniable:

Monthly imports dropped from $796 million in April to $556 million in May

Year-to-date, May volumes were nearly two-thirds lower than the January peak of $1.69 billion

May’s total marks the lowest monthly value since May 2003

This isn’t a seasonal trend, it’s a structural realignment. According to sourcing firm QIMA, U.S. brands have slashed sourcing from China by over 25% compared to 2024, with a 29% jump in orders from Southeast Asia in Q2 alone.

At the same time, Mexico has emerged as a key beneficiary. Apparel imports from Mexico rose 12% year-over-year in May, reaching $259 million, a sign of renewed interest in nearshoring.

The May slump followed the reactivation and expansion of Section 301 tariffs. For apparel companies, this meant triple-digit duties virtually overnight. While some major brands preemptively stockpiled goods in Q1, the longer-term impact is a forced acceleration in diversification.

With U.S. elections looming and tariff regimes potentially shifting again in 2025 and 2026, importers must now balance short-term cost pressures with long-term sourcing strategy. That includes reshaping supplier networks, rerouting logistics flows, and reassessing the viability of longstanding China-based partnerships.

For global apparel companies, the challenge is no longer just about finding cheaper production. it's about finding the right suppliers faster and with confidence.

Trademo Intel empowers sourcing and procurement teams to:

Discover new supplier options in Vietnam, India, Bangladesh, Mexico, and beyond by analyzing verified shipment records and historical trade relationships.

Analyze trade flow patterns to evaluate which suppliers are increasing export volumes, expanding into new markets, or consistently meeting demand.

In the face of rising tariffs, geopolitical risk, and compliance scrutiny, Trademo Intel helps global brands build resilient, cost-effective, and diversified sourcing strategies without guesswork.

Want to see how Trademo Intel can help you identify alternative suppliers and diversify sourcing with confidence?