Comprehensive Risk Intelligence for Trade Finance and Insurance Teams

Streamlining Trade Finance & Insurance with Intelligent Document Processing, Compliance Automation, Trade Analytics and Financial Crime Prevention. Trademo empowers banks and insurers with a unified platform to streamline document digitization with high accuracy document classification and attribute extraction, automated compliance checks and risk assessments, ensuring every transaction is secure and compliant.

Rated 4.8/5 based on 120+ reviews

Automate Trade Document Checks as per ICC rules

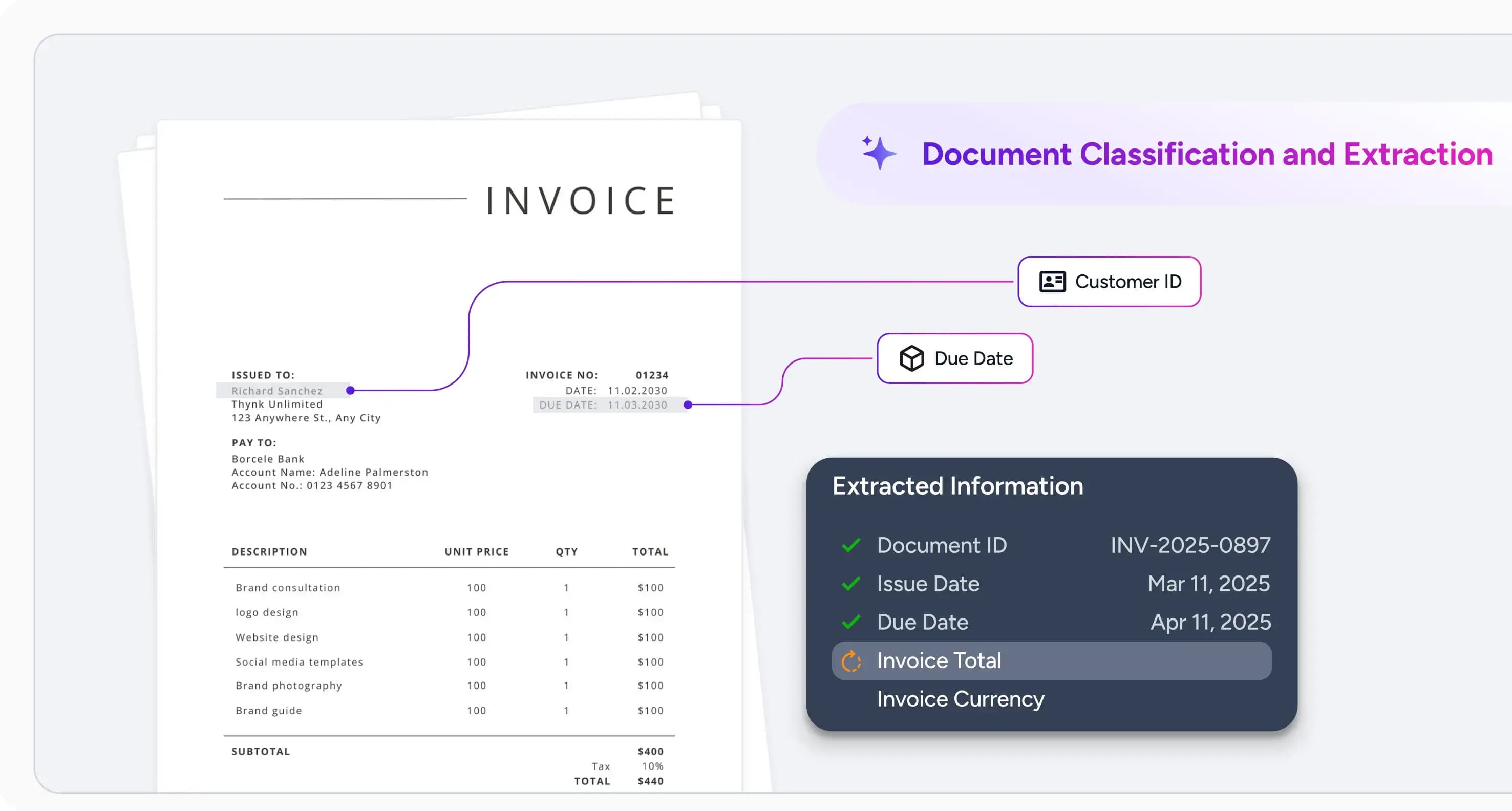

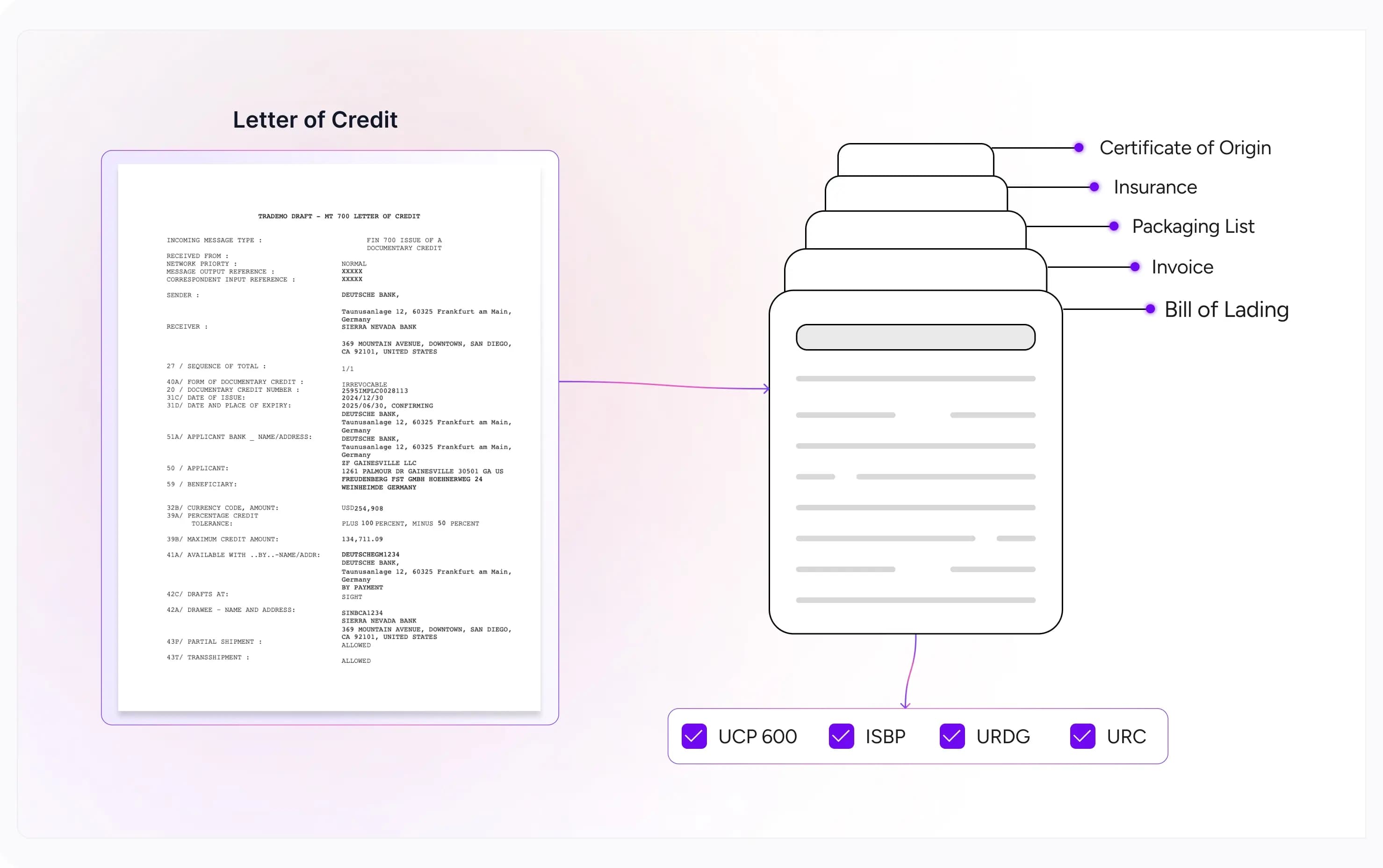

Trademo automatically ingests trade documents and uses AI-powered classification to instantly identify Bills of Lading, Letters of Credit, Commercial Invoices, and more, eliminating manual sorting and accelerating processing across your global trade.

Using advanced extraction capabilities, Trademo accurately pulls key information from a diverse range of transaction documents (LC form, SWIFT LC messages, Certificates, BoL, invoice, packing slip, etc.) with even inconsistent formats and data structures.

Trademo’s Document Check automates verification against UCP, URDG, URC and ISBP rules as applicable, helping trade finance institutions quickly validate trade documents for compliance and accuracy. By reducing manual errors and speeding up document review, it ensures smoother letter of credit processing, lowers operational risk, and accelerates transaction approval.

Ensure 360° Compliance with End-to-End Screening

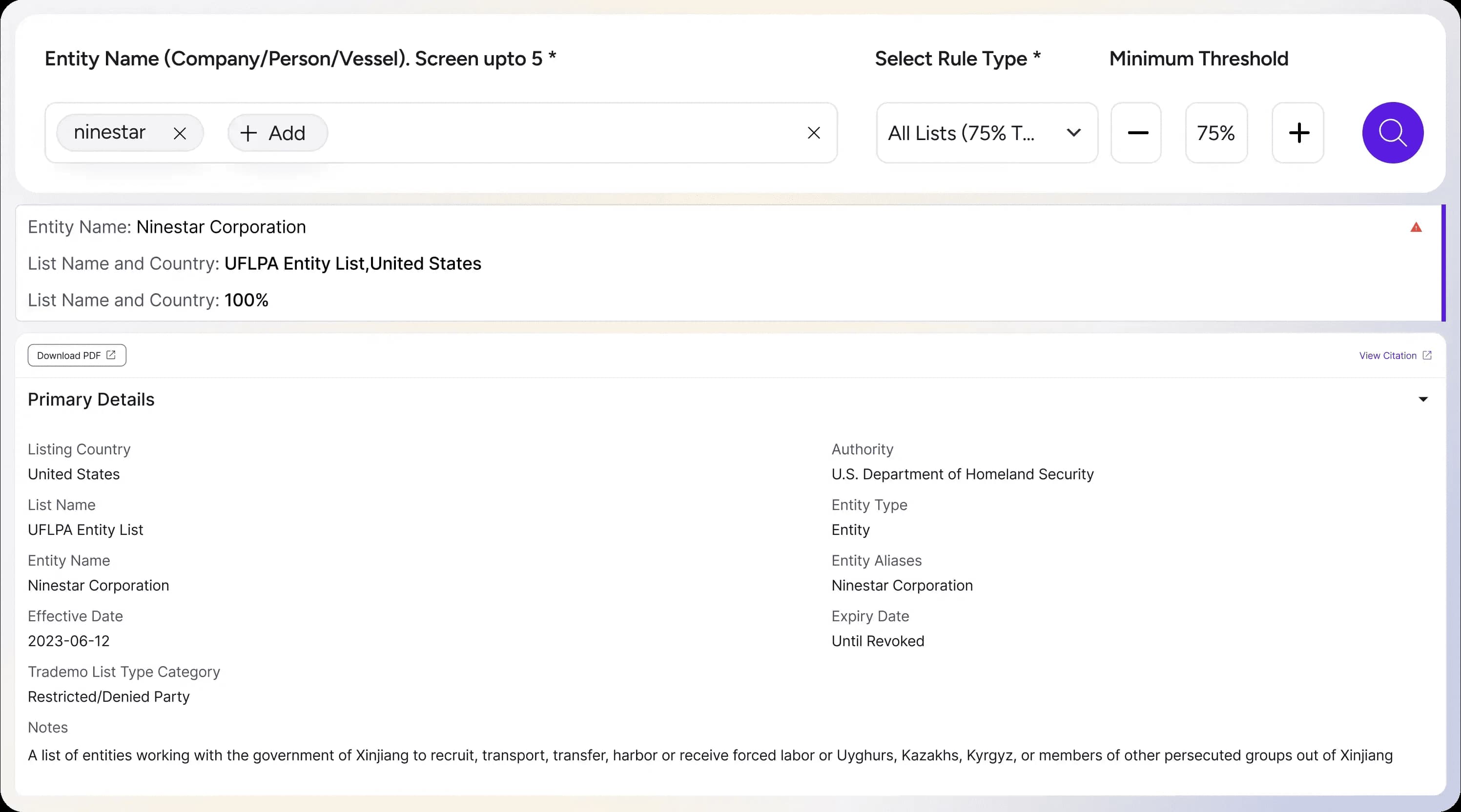

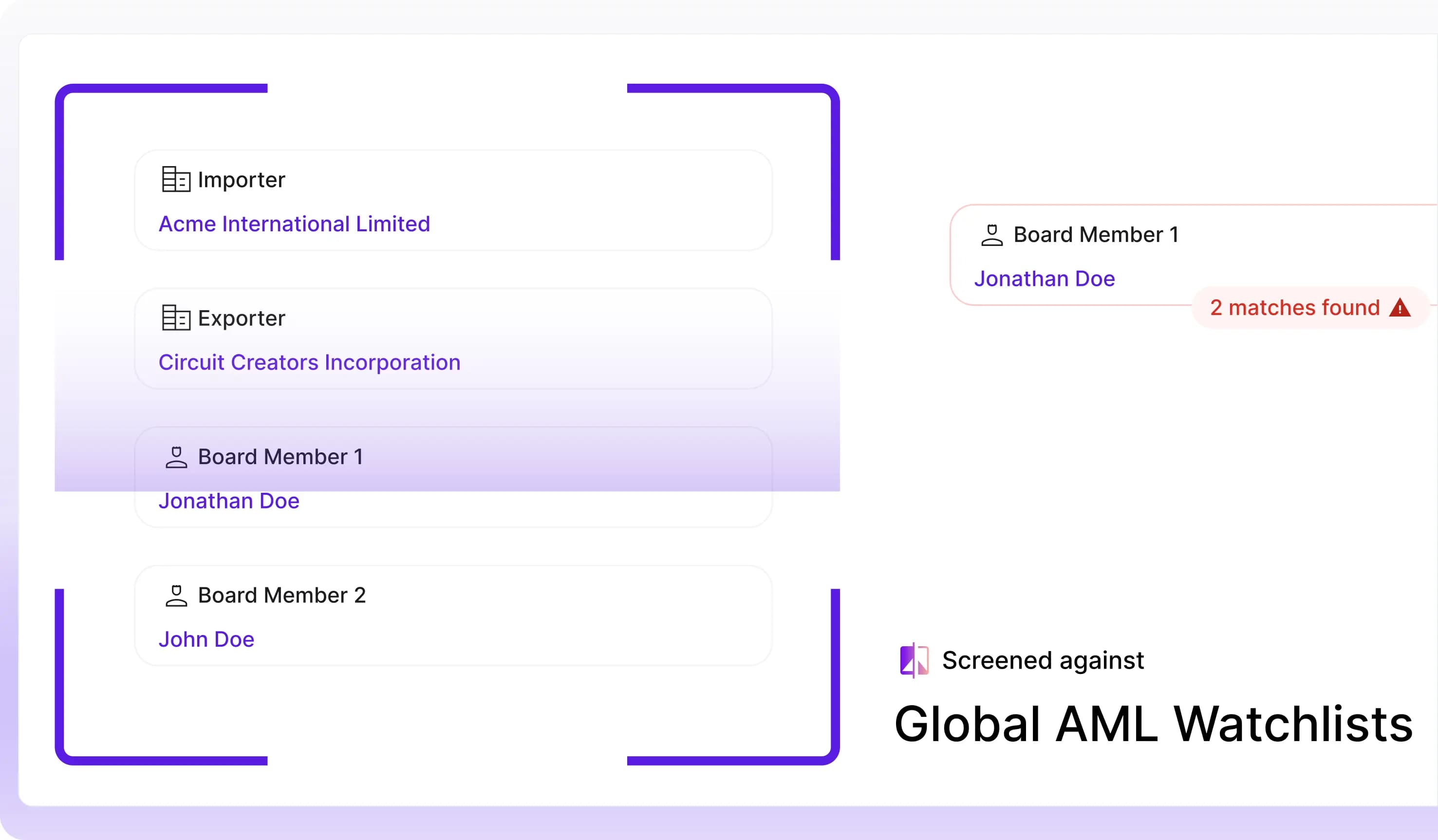

Protect your institution from regulatory exposure with real-time screening of exporters, importers, and trade counterparties against forced labor, 675+ global sanctions and PEP lists. Trademo helps trade finance institutions ensure every transaction is compliant by screening all parties involved, streamlining due diligence, reducing risk, and supporting AML and KYC obligations with confidence.

Ensure compliant financing by thoroughly screening for dual-use, hazardous, restricted/prohibited goods across different trade lanes. Trademo empowers trade finance institutions by offering real-time insights into country-specific trade restrictions, OGA/PGA regulations, and controls to mitigate risks, accelerate due diligence, and facilitate secure, compliant cross-border transactions.

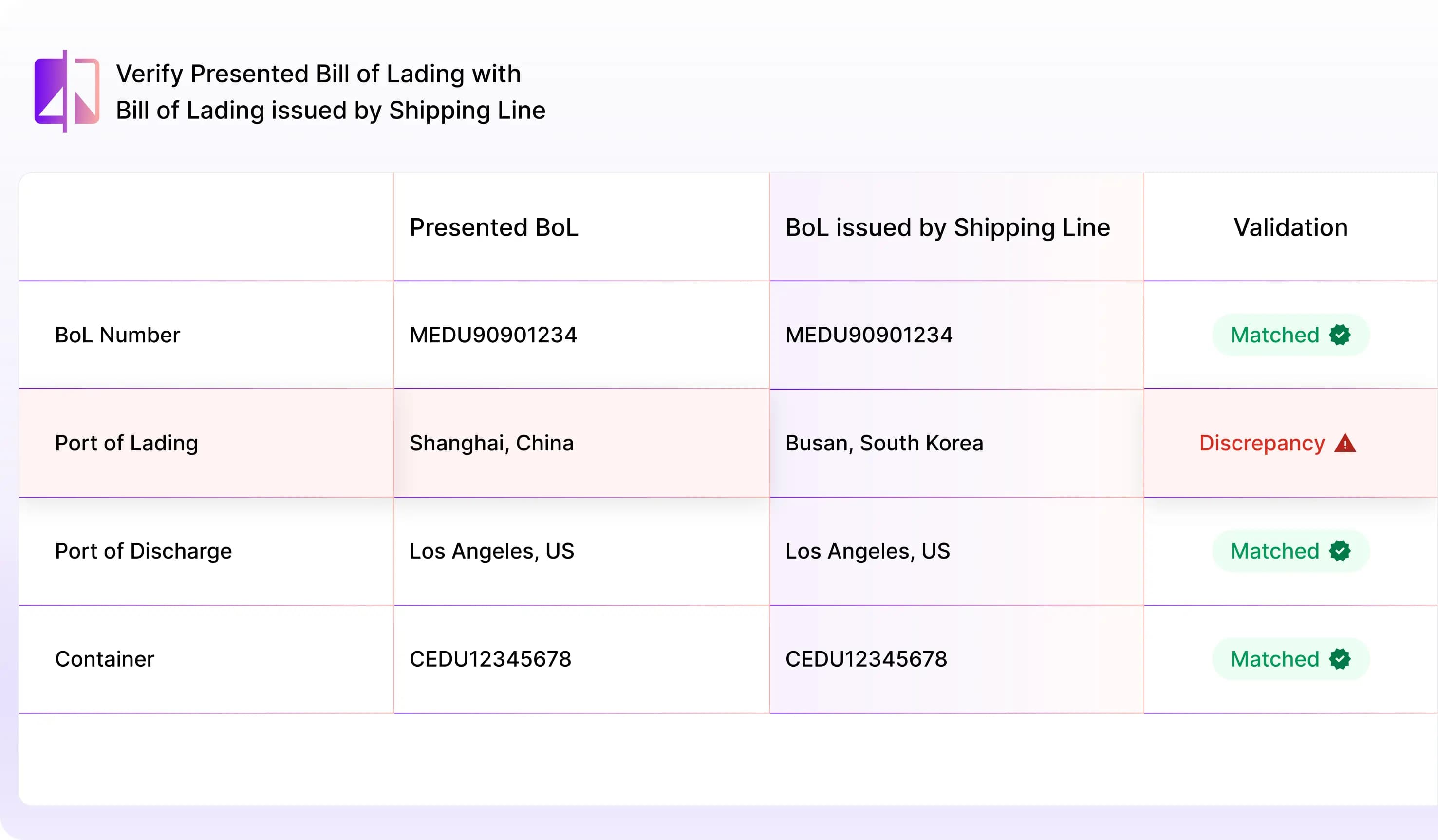

Validate master bill of lading data and get details on transhipment ports, vessel location, and previous port calls of the vessel with the right information from shipping lines. Identify and mitigate risk by screening vessels and shipping entities flagged for maritime sanctions violations.

Detect Financial Crime and Trade-Based Money Laundering Risks

Trademo’s Financial Crime Screening enables trade finance institutions to detect and prevent exposure to money laundering risks. By screening individuals and entities against global AML watchlists, institutions can strengthen compliance, meet regulatory obligations, and make safer financing decisions with confidence.

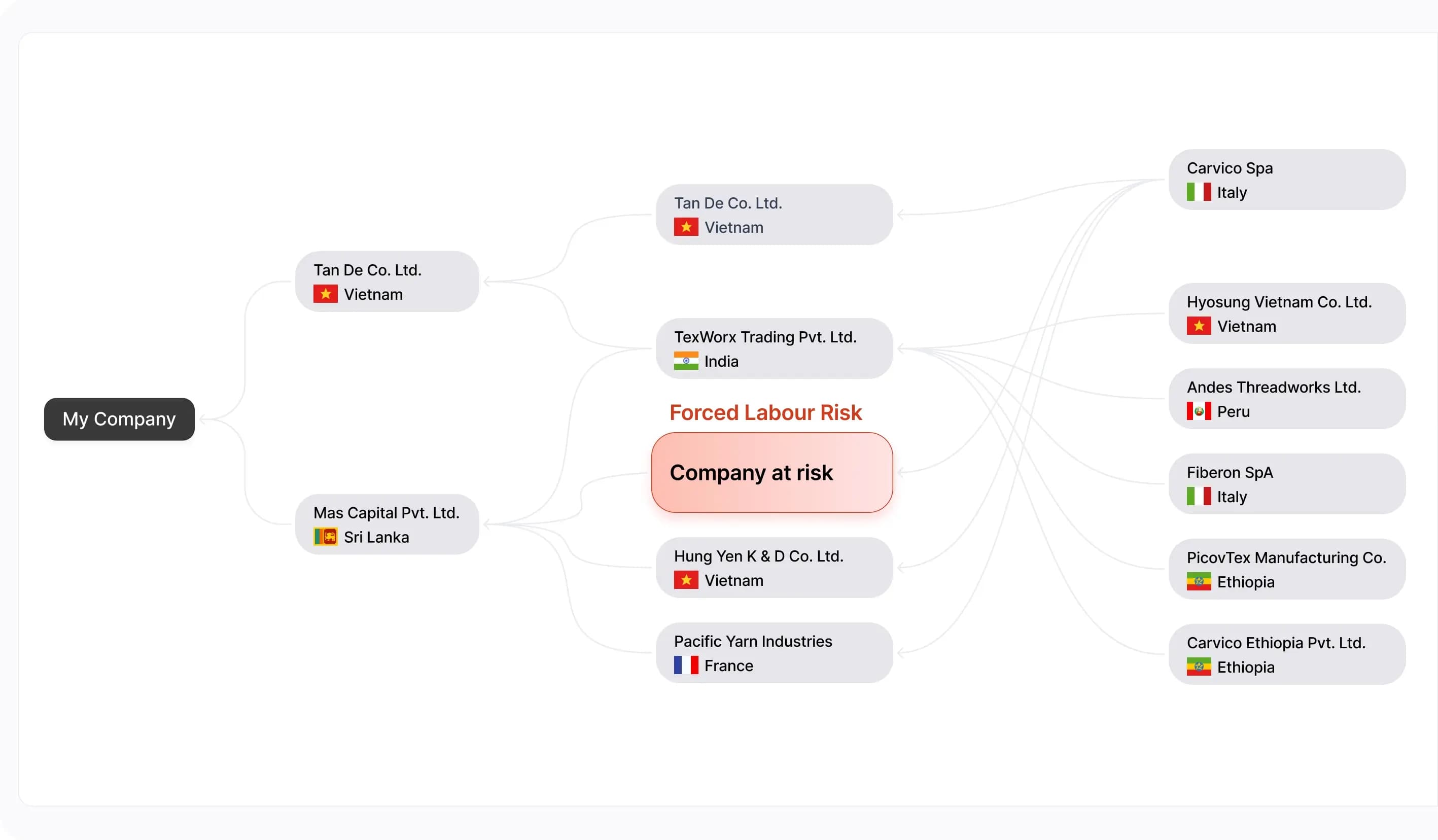

Trademo’s Supply Chain Screening gives trade finance institutions end-to-end visibility into their clients’ supply chains up to tier 4, uncovering hidden risks such as links to sanctioned entities, financial crime exposure, forced labor, and high-risk geographies. This enables more informed credit decisions, robust compliance checks, and stronger risk mitigation across every transaction.

Trademo identifies potential shell companies by analyzing complex ownership structures across global trade data. By tracing parent-subsidiary relationships, beneficial ownership, and linkages between entities, Trademo uncovers hidden connections and abnormal trading behavior. This intelligence helps detect entities with suspicious pattern.

Trademo’s Entity Resolution helps trade finance institutions uncover hidden risks by mapping ownership structures, identifying linked entities, and automatically screening them against global sanctions and watchlists. This end-to-end visibility strengthens due diligence, enhances compliance, and ensures safer financing decisions.

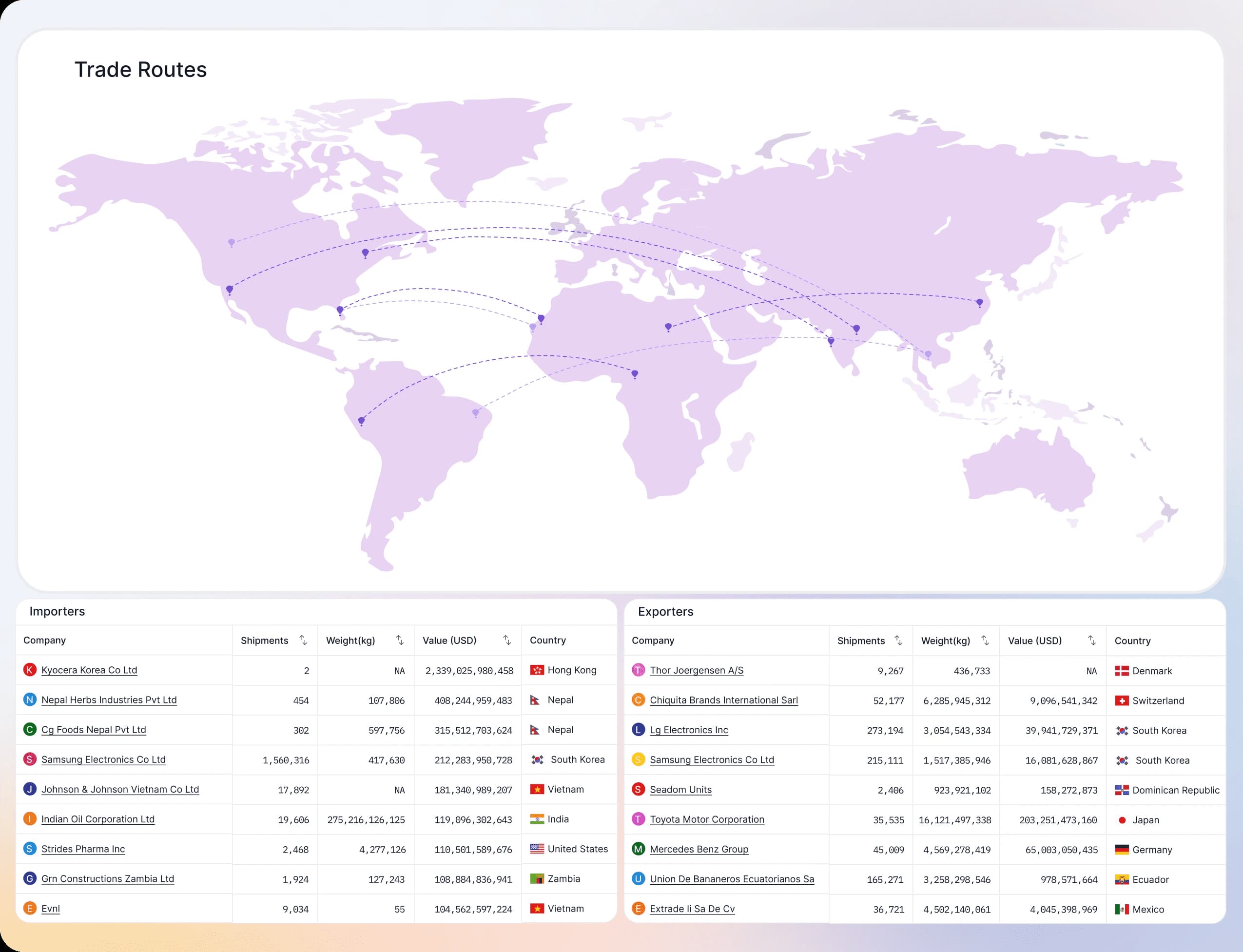

Use global trade intelligence for prospecting and nth tier visibility

Leverage comprehensive trade data to identify and qualify high-potential clients by analyzing their shipment volumes, trade patterns, and compliance profiles. Gain clear visibility into exporters, importers, and trade lanes to target prospects that align with your risk criteria and business goals.

Trademo helps trade finance institutions uncover hidden risks in customer supply chains by providing multi-tier visibility beyond Tier 1. Instantly detect links to sanctioned entities, forced labor networks, and export control violators, including risks buried in ownership structures. Ensure you're not financing illicit trade activity

Key Solutions

FAQs

How can financial institutions manage trade compliance more efficiently?

Platforms like Trademo offer automated compliance solutions that streamline sanctions screening, document verification, and regulatory checks. This helps banks and insurers reduce manual workload, ensure every transaction meets global standards, and minimize operational risk.

How to detect financial crime in global trade?

Trademo’s Financial Crime Screening allows trade finance institutions to identify exposure to bribery, corruption, and trade-based money laundering. By screening individuals and entities against global watchlists, Trademo supports AML compliance and helps prevent fraud in cross-border transactions.

How can banks verify trade documents quickly and accurately?

With Trademo’s Document Check, banks can automatically validate trade documents against UCP and ISBP rules. This automation reduces human error, speeds up letter of credit processing, and lowers the risk of transaction delays.

How can institutions screen goods for trade restrictions?

Trademo enables automated screening of dual-use, hazardous, or sensitive goods across origin, destination, and HS classifications. This ensures compliance with country-specific controls and regulatory requirements such as OGA and PGA mandates.

How can I identify shell companies or suspicious trading behavior?

Trademo uncovers shell companies and suspicious trade behavior by analyzing ownership structures, beneficial ownership, and entity linkages across global trade data, revealing hidden connections and abnormal patterns.

How to assess risk across a client’s global trade?

Trademo’s Supply Chain Screening gives financial institutions visibility into clients’ supply chains up to tier 4. This helps detect links to sanctioned entities, forced labor, or financial crime exposure, strengthening risk management and compliance.

APIs

Data License

AI Agents

Solutions

Pricing

Company

Location

California: 3000 El Camino Real, Building 4, Suite 200, Palo Alto, California 94306

India: 2nd Floor, Plot No. 136, Sector 44, Gurgram, Haryana 122003