Videos & Webinars

Watch videos featuring supply chain experts

Trade Compliance in current times is like walking on a tightrope. As the global marketplace continues to expand, the ever-changing global trade laws and newer commercial agreements between countries have further widened the scope of global trade compliance. While being compliant has its rewards, any form of non-compliance can turn out to be the worst nightmare for companies.

Clearly, trade compliance has become more than simply following export/import regulations. Companies are experiencing the pressing urgency to have a rounded trade compliance framework to support their key trade practices, manage supply chains effectively, and also mitigate related risks.

As companies wonder if they are truly trade-compliant, we are here to address the multitude of concerns that arise. In this blog, we talk about the different aspects associated with trade compliance, why you need it, and how you can go about strategizing foreign trade compliance for your business.

Global trade compliance and international trade compliance are terms used interchangeably for defining the process that ensures companies don't infringe on international and national trade laws, rules, and regulations. Essentially, trade compliance incorporates all the terms, conditions, and procedures that regulate any kind of trade taking place between two or more countries.

The main aim of trade compliance is to guarantee the upholding of ethical trade practices and national security in any commercial operation happening between different countries. Trading parties are expected to abide by the regulations of their respective countries’ laws related to international trade, export, and finance.

It is to be noted that countries share numerous treaties and regulations differentiated based on the country of origin and nature of goods.

A closely related concept is import/export compliance. This essentially defines the lawful exchange or import/export of goods and services between countries as part of a certain supply chain. Import/export compliance aims to help companies abide by all the rules and treaties while expanding their business internationally and achieving a better position in the marketplace.

Any business regardless of the industry type, involved in any commercial exchange across international or national borders is expected to be trade compliant. Companies must ensure that the execution of related responsibilities aligns consistently with international trade regulations and particular companies' procedures.

The global trade front is getting increasingly extensive and complex. With the rise of numerous disruptive factors including geopolitical tensions, protectionism, pandemic, and more, countries around the globe are coming up with laws and regulations to protect their economy and people. The compliance expectations also grow depending on the size of the business which makes it more challenging to meet them.

Let's look at some of the major reasons that make international trade compliance so important for businesses:

Ensuring complete and abject trade compliance is everything but an easy process. There are plenty of complexities and stakeholders involved giving way to endless possibilities of errors and subsequent penalties, operational disruptions, delays, seizures, and whatnot.

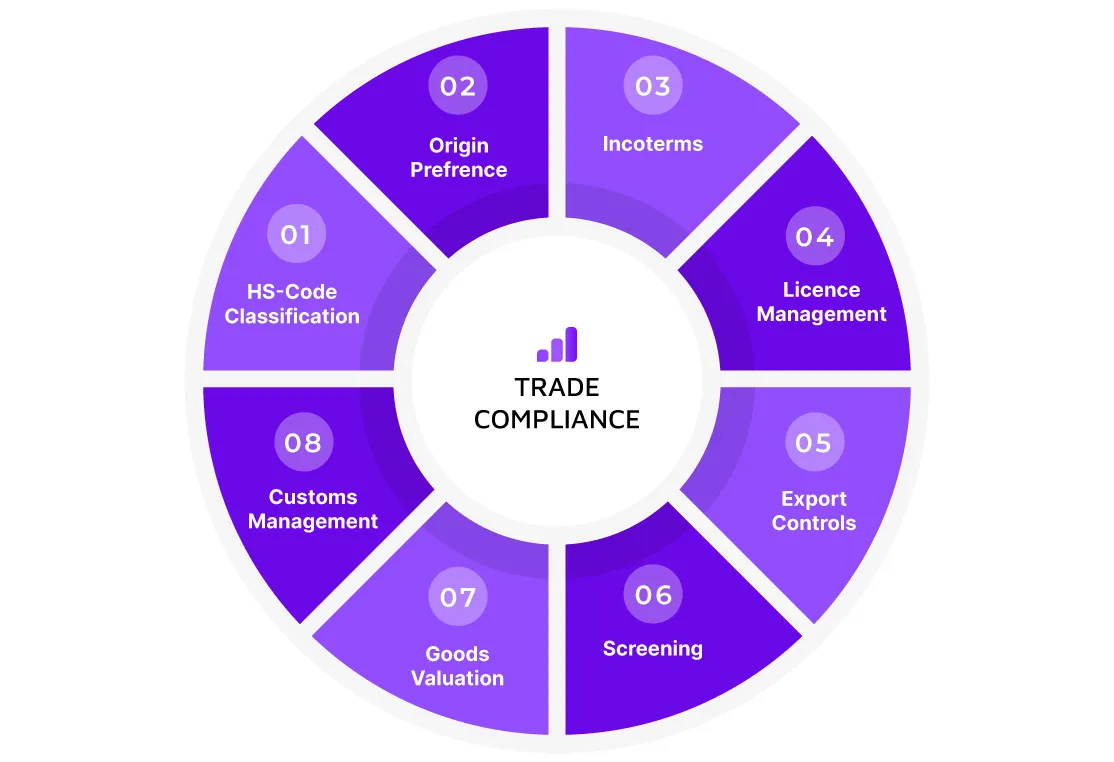

Trade compliance can be understood as several key elements, policies, and multiple procedures working together most accurately. Here, identifying the key elements of trade compliance is the first and most vital step for laying a robust foundation for a truly compliant business.

Let's see what are all the core elements of trade compliance.

The Harmonized Commodity Description and Coding System, simply known as Harmonized System, is an international nomenclature system designed by the World Customs Organization. This HS system is used for the classification or numbering of goods. This further helps with statistical purposes and the collection of fair duties.

It's crucial to classify goods correctly according to the tariff and commodity codes. However, this process is highly prone to errors followed by grave results in the form of penalties, fines, and even investigations. Thereby, the tariff classification must be done accurately and responsibly.

Preferential origin is a product of particular trade agreements between two or a block of countries. This involves listing certain export items that become eligible for preferential rates of duty in the customer country after meeting certain criteria. Such export items attract nil or reduced rates of duty when traded between concerned countries. Exporters need to strictly ensure adherence to the rules of preferential origin. Any deference to the same can invite unpaid or unfair duty for up to 3 years.

There also exists Non-preferential origin which is used to ascertain the origin of all international shipments. The importing country determines the rules associated with origin identification. If done erroneously, the importers may be levied penalties and fines.

International Commercial Terms or Incoterms define the roles and responsibilities of the stakeholders involved in different activities along the shipment lifecycle including trade compliance, delivery, duties, taxes, etc. Essentially, Incoterms are a globally recognized set of guidelines to streamline and enable shipments as per strict commercial laws.

Incoterms are crucial for contracts as they help involved parties to attain clarity on costs, responsibilities, risks, and delivery. Correct application and assessment of incoterms can save a great amount of confusion, overpayment, and dispute risks.

Importing/exporting from countries also involves a set of licenses or permits. These represent the controls imposed on certain types of commodities like military goods, technological items, chemicals, medicines, artworks, etc.

It is of utmost importance for importers and exporters to check whether they need any licenses or permits. The absence of a right license is treated as a criminal offense and leads to customs delays or worse, confiscation of goods. Thereby, businesses must lay particular license management controls and responsibilities to ensure customs trade compliance.

There are administrative and operational procedures for the submission of documents relating to the application for exporting goods. Export control legislation applies to several goods and associated technologies that can have potential negative usage. Mostly, EAR (Export Administration Regulations) and ITAR (International Traffic in Arms Regulations) lay the basis for the different controls.

Dealing with such goods makes accurate product classification against the right legislation even more important for ensuring proper licensing. Non-compliance here can cost you heavy and invite imprisonment too in some cases.

Also called Denied Party Screening or Restricted Party Screening, this process is a crucial step in international trade compliance. Screening involves the identification of restricted/partially restricted goods or entities facing sanctions, geopolitical, or other types of risks. The aim is to prevent such entities from getting involved in the trade. It also requires businesses to stay on top of all the frequent updates in the list of embargoed countries and goods.

Screening is done by comparing the customer, vendor, transaction, or employee data with the data of external source(s) like the UN, Office of Foreign Assets Control, and many more. It's important to conduct periodic and frequent screening as any breach can bring fines or even jail.

A fair and accurate valuation of goods is crucial to global trade compliance. This enables import/export at a ‘fair rate’ as countries can levy the right duties and taxes on goods entering their borders. The World Trade Organization has approved six valuation methodologies out of which at least one must be applied for each shipment. Next, the value must be declared on Single Administrative Document. This valuation should be accurate as such that it can be defended and justified.

Incorrect valuation of goods can lead to the imposition of penalties and fines plus due payment of the duties. The customs authorities can also question the valuation methodology, thus, it's important to double-check for any discrepancy.

This involves the streamlined and effective processing of traded goods alongside ensuring their adherence to all the trade compliance regulations. Businesses with the possibility of exposure to customs investigation must have an action plan ready for faster and smooth customs management.

The ever-complicating global trade landscape is also adding to the consequence of non-compliance. Non-compliance is considered a bad trading practice where companies don't pay attention to the various nuances and risks related to foreign trade compliance. The common factors that affect the nature of consequences include-

Mostly, companies fail to understand the severity of violations and assume less than the potential consequences of non-compliance. The range of repercussions includes short-term losses as well as irreparable damages. Take a look at this list:

Being trade compliant is an essential practice for doing international business. Businesses may hesitate to putto put resources into an international trade compliance program as international trading is already costly. However, the gains from this investment go long-term and beyond the prevention of costly violations.

Let's see the advantages that come out when trade and compliance meet.

Non-compliance increases the risks to the overall management and performance of companies. A global trade compliance program ensures effective compliance to mitigate the risks emerging from custom audits. It not only reduces the risks like penalties, sanctions, etc. but also saves any profit loss.

Imports/Exports pass through various checks levied by different government agencies and customs authorities. Effective trade compliance ensures proactive identification and execution of all such requirements. Thereby, authorities tend to process shipments faster when compliance information and checks are in place accurately and well in advance.

Staying updated with global trade regulations can help you unearth hidden opportunities for savings while calculating accurate landed cost. You can leverage any existing free trade agreements for reducing or even eliminating trade tariffs. Correct classification of goods and establishing the country of origin can lead to savings of duties if rates are lower.

Staying compliant helps companies minimize risks and further optimize their business performance. Goods move faster if the compliance checks meet no hurdle. As a result, companies can ensure timely deliveries and quality service to their customers and boost their profits and brand loyalty simultaneously. Companies can make the most out of such customer relationship management by promoting it as an added value.

The combination of effective trade compliance, risk management, and customer satisfaction can get companies a significant competitive advantage over their competitors. They can manage their supply chains much more efficiently which also helps them to boost product quality and profits. Moreover, businesses also gain a higher reputation and trust among government agencies and their trading partners.

Complete trade compliance puts all the pieces together by ensuring all the data and documentation support fair and compliant import/export declarations that further lead to the smooth movement of goods. This results in a supply chain that is agile, visible, and free of bottlenecks.

It's time organizations need to see trade compliance beyond just a law obeyance procedure. They must make it a part of their overall cultural vision and value to finally realize its true potential and benefits. While businesses often tend to resist integrating compliance due to costs and efficiency concerns, these become real problems in case of inefficient compliance.

It doesn’t matter if you are attempting trade compliance for the first time or revising an old compliance strategy, the process requires a teamed approach. Here are some of the common yet essential steps you can take while planning efficient foreign trade compliance.

Looking for a solution that makes trade compliance easy on your resources and time? Meet Trademo Compliance.

Trade compliance is a critical need for modern businesses and evidently enough, there is no shortcut to it. It has become the door to international business as trade-compliant companies are perceived to be providing assured product and service delivery. Thereby, companies need to leverage every ounce of due diligence while complying with the requirements as trade compliance is more about farseeing and driving actions and less about reflexes.