Stay Compliant with Real-Time Global Trade Intelligence

Trademo Global Trade Content delivers real-time visibility into tariffs, duties, import and export controls, embargoes, and regulatory rulings, enabling faster decision-making and ensuring full adherence to global trade regulations.

___COMPLIANCE

Power Your Compliance Journey with Real-Time Trade Content

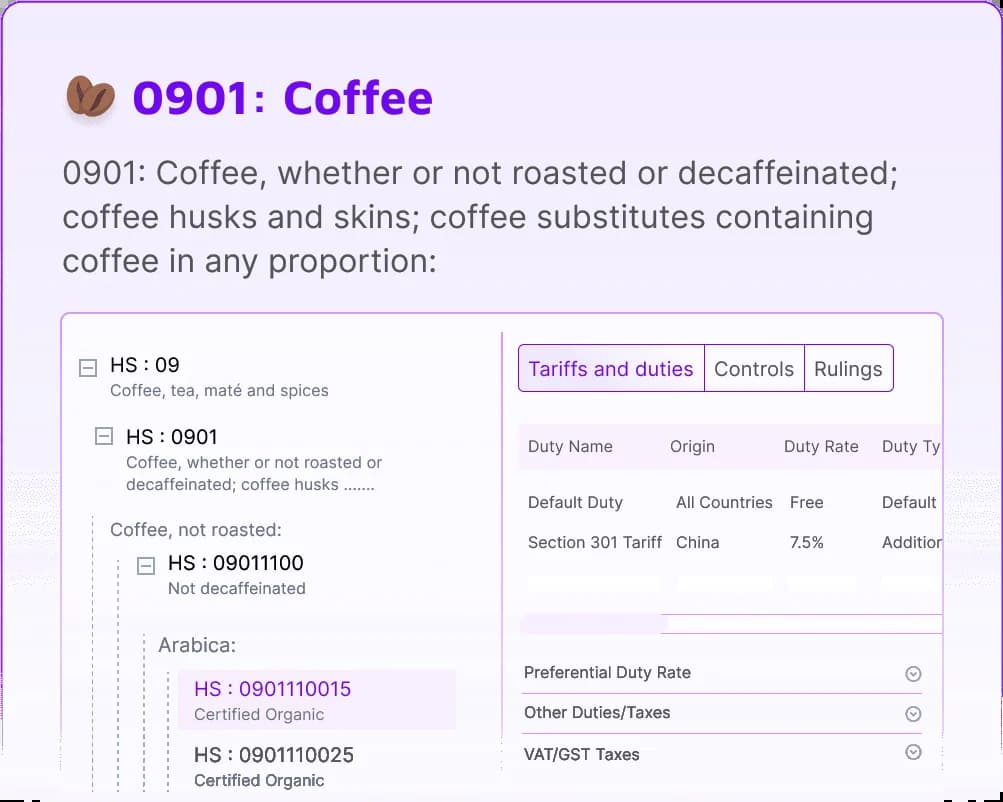

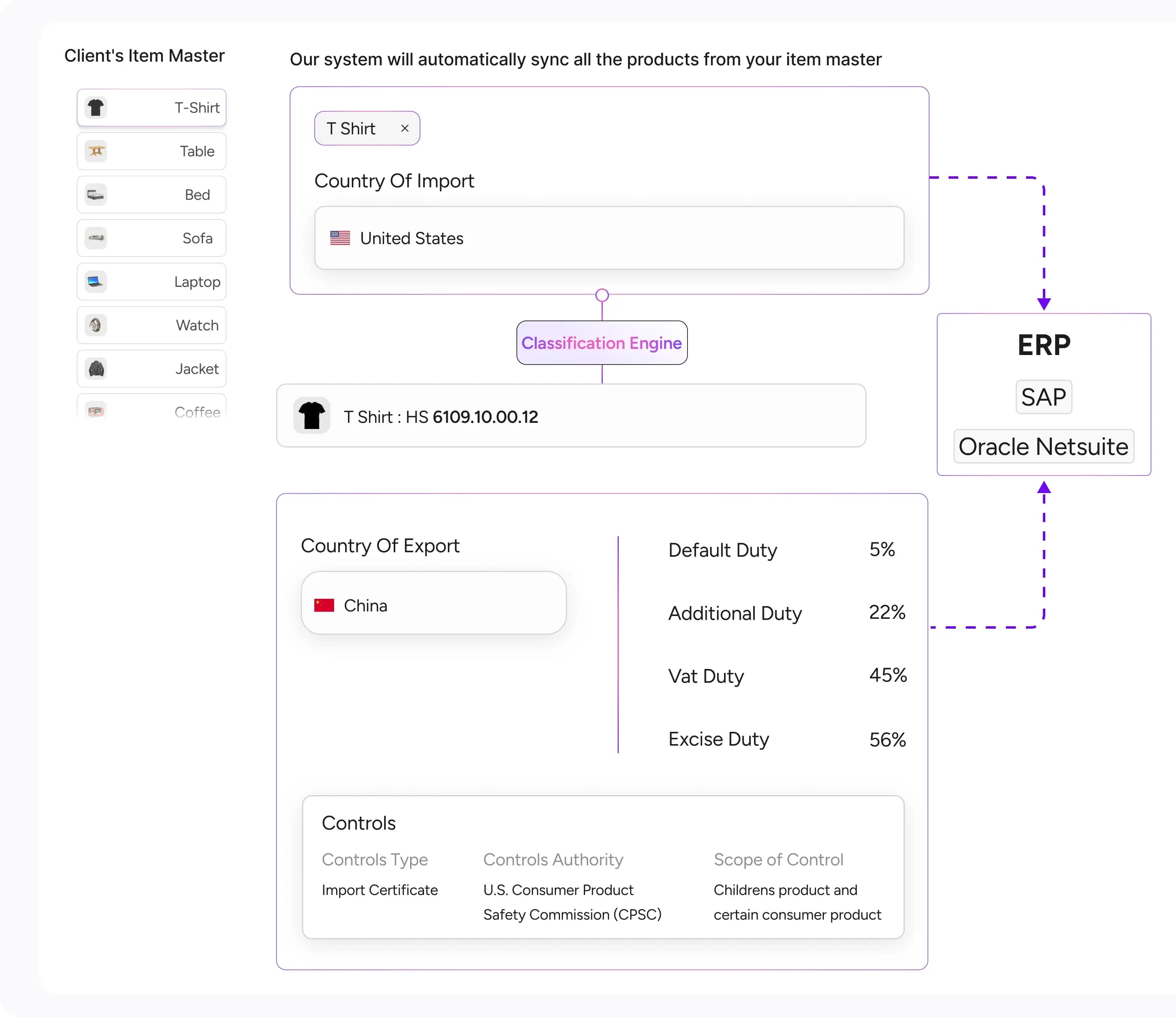

Make Your Products Trade Ready

Trademo Global Trade Content provides real-time, authoritative data on tariffs, duties, and regulatory requirements giving you the foundation to ensure your products are globally compliant from day one.

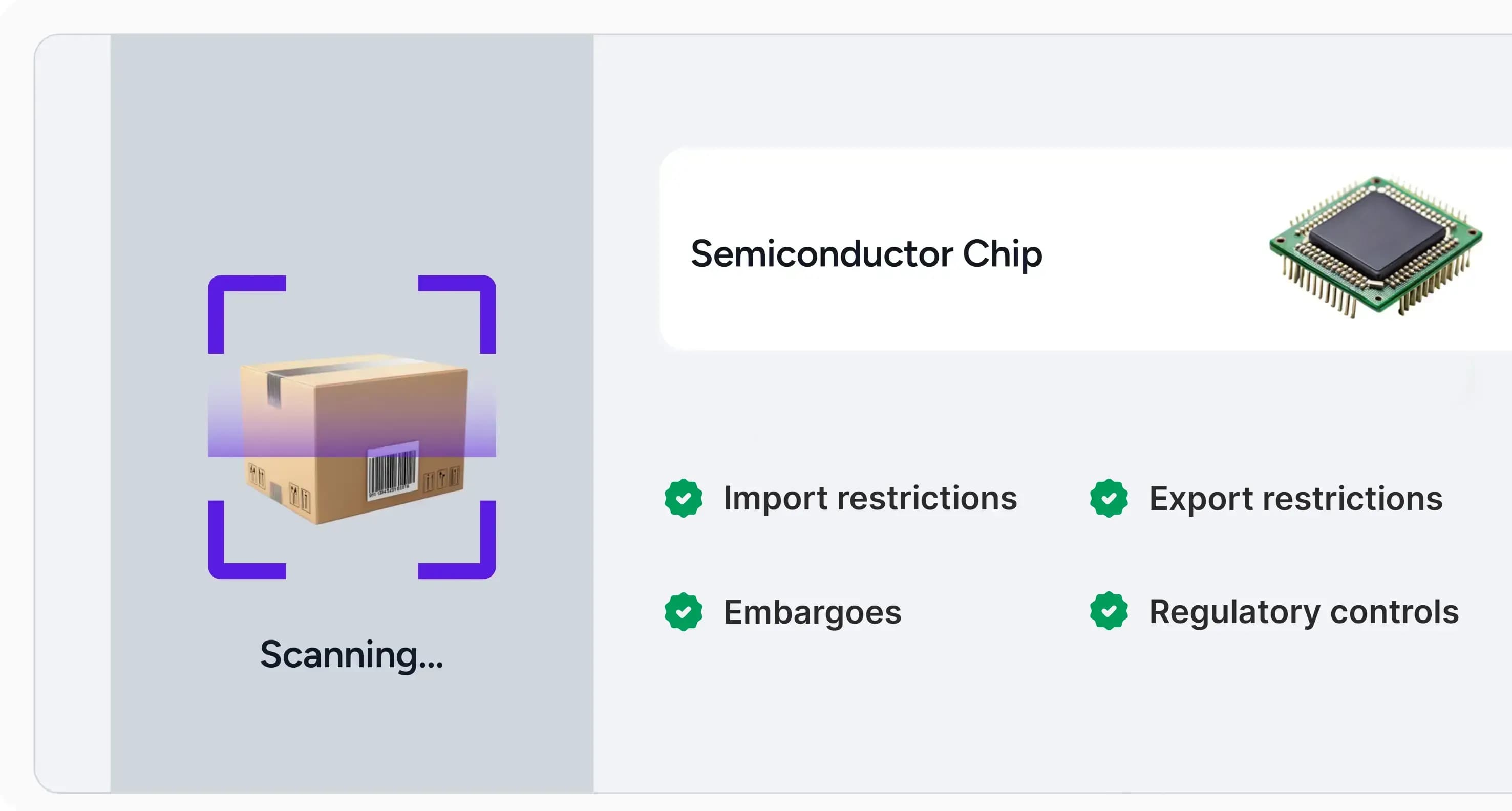

Mitigate Risk and Prevent Disruptions

Gain a 360° view of global trade regulations to reduce the risk of penalties, delays, shipment seizures, and non-compliance. Trademo helps you maintain smooth cross-border operations by providing visibility into fast-changing rules and country-specific requirements.

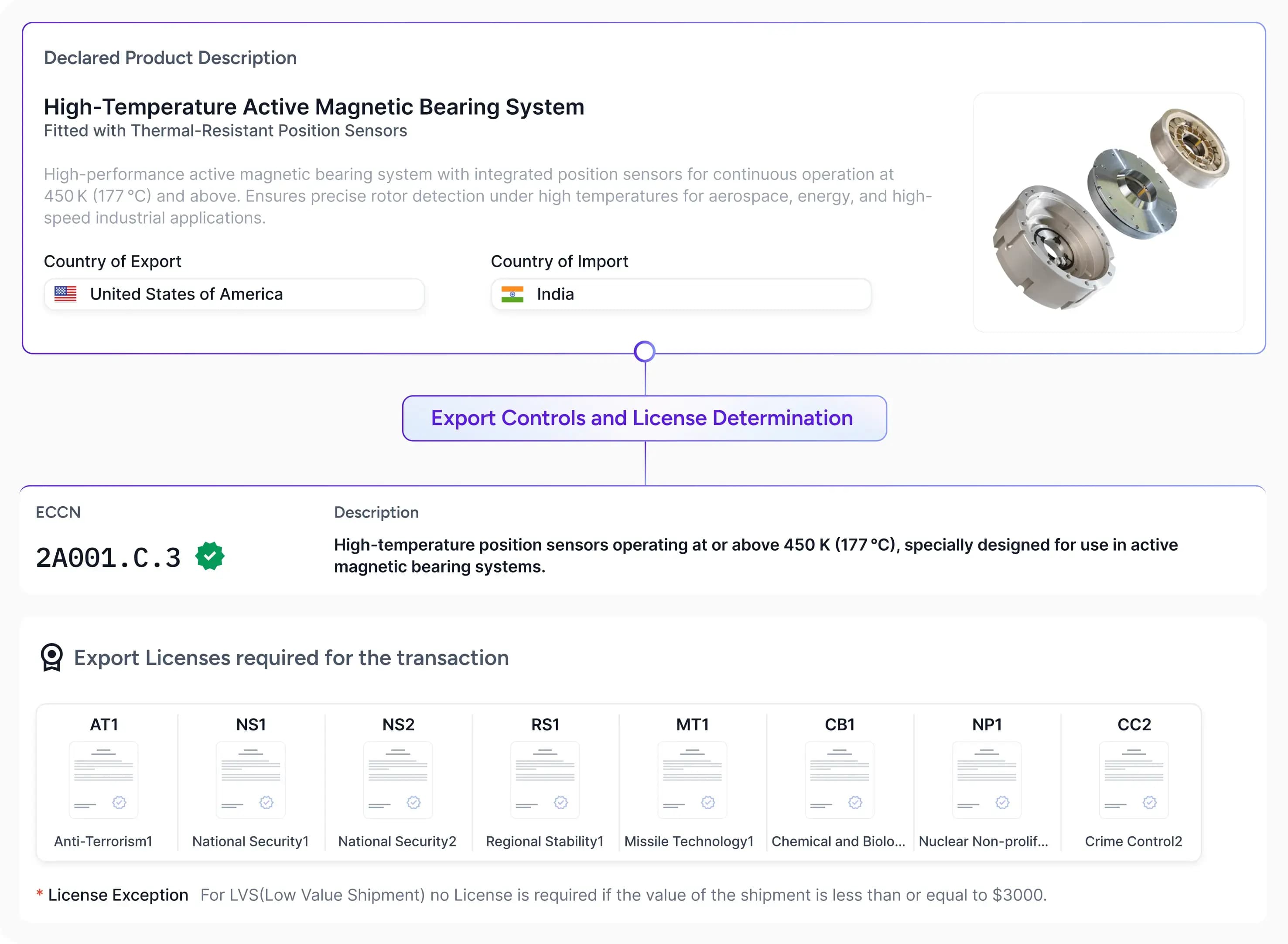

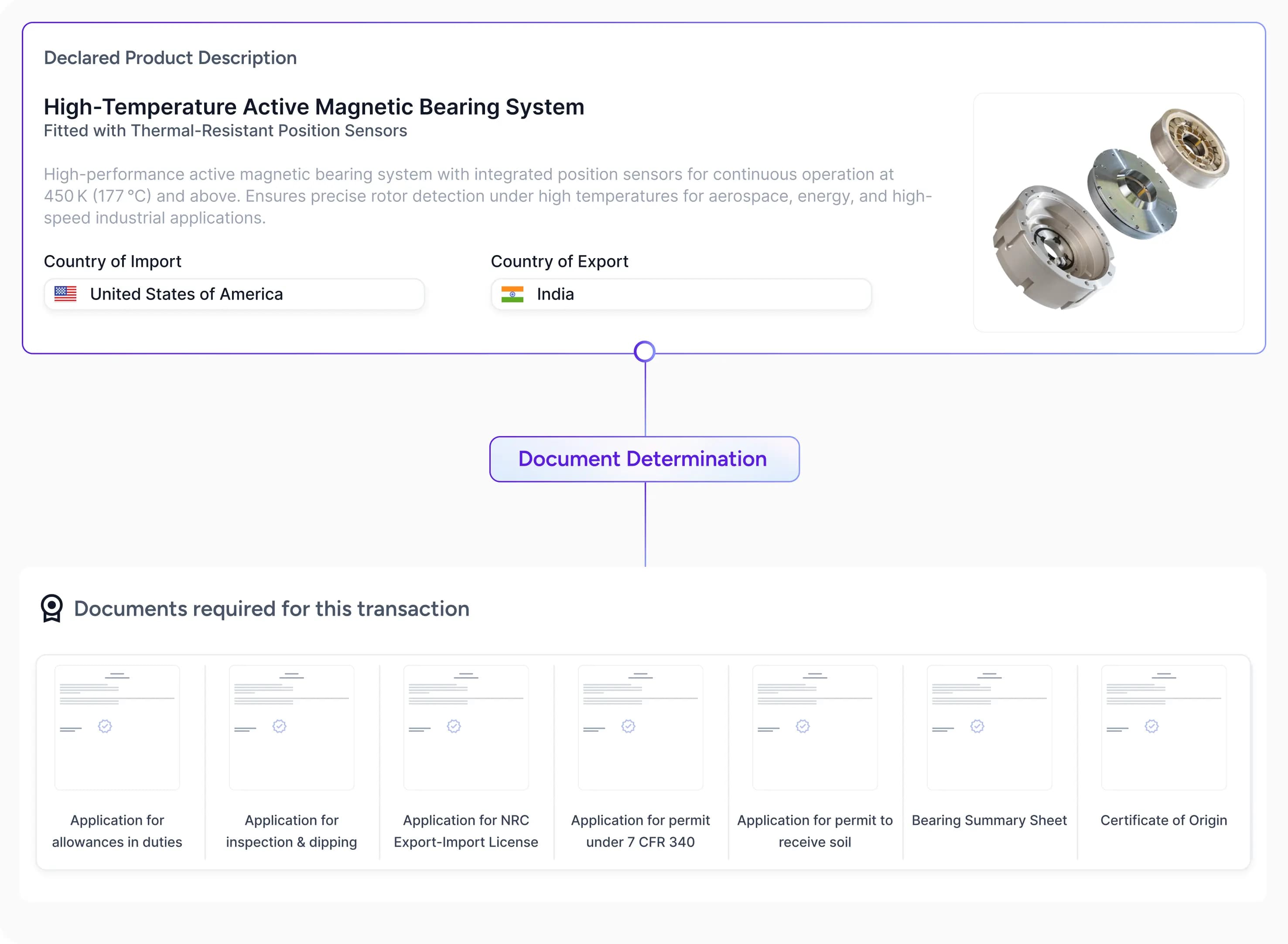

Achieve 360° Compliance For Imports and Exports with Our Global Trade Content

Stay Ahead of Regulatory Changes with Extensive Global Trade Content

140+

Countries Covered

880K+

Tariffs, Controls, and Duties

300+

Free Trade Agreements Monitored

1-Day

Update Frequency